Laser vision correction has become increasingly popular among people looking to reduce dependence on glasses or contact lenses. However, one of the most common questions patients ask is whether laser eye surgery health insurance actually exists and if so, what it covers.

This comprehensive guide explains how laser eye surgery health insurance works, what most policies include (and exclude), how much you can expect to pay, and practical ways to reduce costs. We’ll also explore supporting options such as LASIK insurance coverage, vision correction insurance, and eye surgery medical coverage, along with frequently asked questions.

Whether you’re just starting your research or preparing for surgery, this article will help you make informed decisions.

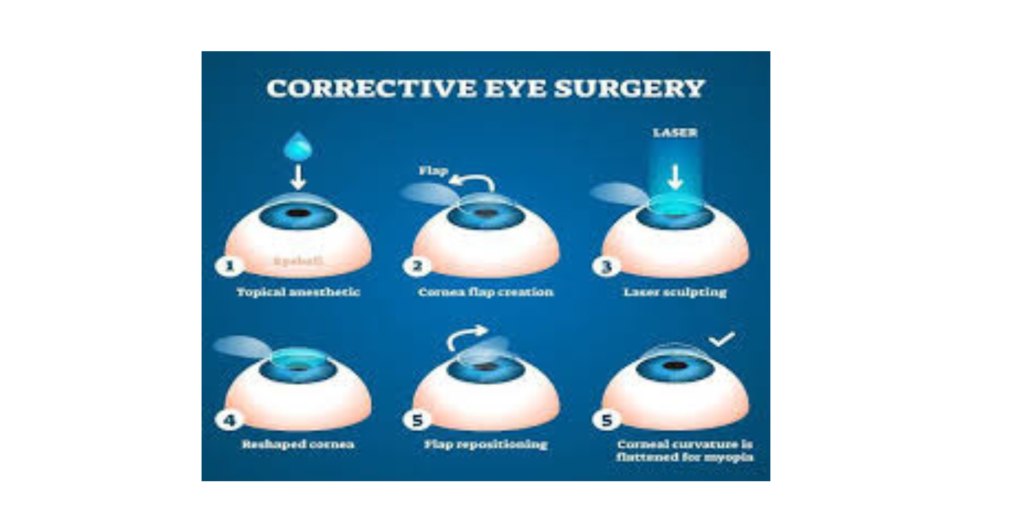

What Is Laser Eye Surgery?

Laser eye surgery refers to procedures that reshape the cornea to improve how light enters the eye, allowing images to focus correctly on the retina. It is commonly used to treat:

- Nearsightedness (myopia)

- Farsightedness (hyperopia)

- Astigmatism

Popular techniques include LASIK, PRK, and SMILE. These procedures are usually quick, often completed within 30 minutes, and many patients notice improved vision within days.

Despite its effectiveness, laser eye surgery is typically classified as elective, which directly affects insurance coverage.

Laser Eye Surgery Health Insurance is basically your financial backup when you’re considering vision correction because let’s be real, procedures like LASIK aren’t cheap. In most countries, this treatment is classed as elective, which means standard policies (and even public systems like National Health Service) usually don’t cover it unless there’s a medical reason, not just blurry vision. That’s why some private insurers offer partial reimbursement or special add-ons, covering things like pre-op eye exams, post-surgery care, or complications. Pro tip: always check waiting periods, exclusions, and annual limits before you commit a little policy homework can save you serious money and stress later.

How Laser Eye Surgery Health Insurance Works

In most countries, standard health insurance plans do not fully cover laser eye surgery. Insurers usually consider it a non-essential or cosmetic procedure because vision can technically be corrected with glasses or contact lenses.

However, laser eye surgery health insurance may apply in limited situations, such as:

- Severe corneal damage or disease

- Vision loss caused by injury

- Refractive errors that cannot be corrected with lenses

- Medical necessity confirmed by an ophthalmologist

Outside of these cases, patients often need to pay out of pocket.

Some plans offer partial financial assistance through:

- Vision correction insurance add-ons

- Discount programs with partnered clinics

- Reimbursement options

- Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA)

These options do not usually provide full coverage but can significantly reduce overall costs.

Keeping your heart healthy doesn’t have to be complicated Just a few smart daily habits can seriously level up your wellness game and help prevent heart disease before it even starts. If you’re curious about simple, realistic ways to keep your ticker strong, check out this guide: https://webthreds.com/5-daily-habits-that-prevent-heart-disease-keep-your-heart-strong/ it’s full of easy tips you can actually stick to.

Supporting Coverage Options You Should Know

Alongside laser eye surgery health insurance, patients frequently encounter the following related coverage types:

1. LASIK Insurance Coverage

Most traditional policies exclude LASIK, but some vision plans offer discounted rates through approved providers.

2. Vision Correction Insurance

This is typically separate from general health insurance and may include partial reimbursement or negotiated pricing for laser procedures.

3. Eye Surgery Medical Coverage

This applies when surgery is medically required rather than elective, such as after trauma or in certain corneal conditions.

Understanding these categories helps you identify realistic financial expectations before scheduling surgery.

Does Health Insurance Cover Laser Eye Surgery?

A common long-tail question is: does health insurance cover laser eye surgery?

In most cases, the answer is no at least not fully.

Insurance providers generally cover laser eye surgery only when it is medically necessary. For example:

- Post-injury vision correction

- Vision loss caused by disease

- Structural corneal abnormalities

If your situation falls into one of these categories, your ophthalmologist may submit documentation to support a claim.

For elective procedures, patients typically rely on personal funds, FSAs/HSAs, or clinic financing.

Average Cost of Laser Eye Surgery Without Insurance

Without laser eye surgery health insurance, prices vary based on location, clinic reputation, and technology used.

On average, patients may pay:

- Per eye: moderate to high three-figure or low four-figure range

- Both eyes combined: often several thousand in total

Many clinics offer payment plans, allowing patients to spread costs over several months.

Ways to Reduce Laser Eye Surgery Costs

Even without full insurance coverage, there are several strategies to make treatment more affordable.

Use FSA or HSA Accounts

These accounts allow you to pay with pre-tax income, effectively lowering the total cost.

Ask About Clinic Payment Plans

Most reputable eye centers provide installment options.

Look for Seasonal Promotions

Some clinics offer discounts during slower periods of the year.

Check Vision Plan Partnerships

Certain vision correction insurance programs provide reduced pricing through partner providers.

Combining these methods can significantly lower your financial burden.

Medical Considerations Before Surgery

Before approving laser eye surgery, your doctor will assess:

- Corneal thickness

- Overall eye health

- Prescription stability

- Medical history

- Current medications

Organizations such as Mayo Clinic emphasize that overall health plays an important role in surgical recovery. Conditions affecting immune response or healing may require additional evaluation before proceeding.

A thorough pre-operative assessment ensures safety and improves long-term results.

Recovery Expectations After Laser Eye Surgery

While recovery varies from person to person, a general timeline looks like this:

First 24 Hours

- Blurry vision

- Light sensitivity

- Mild burning or dryness

First Week

- Vision gradually stabilizes

- Dry eyes may peak

- Regular use of prescribed eye drops

First Month

- Continued improvement in clarity

- Reduced glare or halos

- Corneal healing nearing completion

Most patients return to normal activities within a few days, although full stabilization can take several weeks.

FAQs About Laser Eye Surgery Health Insurance

Is laser eye surgery covered by health insurance?

Usually not, unless the procedure is medically necessary due to injury or disease.

Can I use HSA or FSA funds for laser eye surgery?

Yes. Most clinics accept both, allowing you to pay with pre-tax money.

What is the difference between vision insurance and health insurance?

Health insurance focuses on medical care, while vision correction insurance may offer discounts or partial reimbursement for procedures like LASIK.

Are payment plans available?

Yes. Many surgical centers provide monthly installment options.

How do I know if my surgery qualifies for medical coverage?

Your ophthalmologist must document medical necessity and submit it to your insurer for review.

Is laser eye surgery a permanent solution?

For most patients, results are long-lasting, though natural age-related vision changes can still occur over time.

Final Thoughts

Laser eye surgery offers a life-changing opportunity to improve vision and reduce dependence on corrective lenses. However, understanding laser eye surgery health insurance is essential before moving forward.

While full coverage is uncommon, options such as LASIK insurance coverage, vision correction insurance, and eye surgery medical coverage can help reduce expenses. Flexible spending accounts, payment plans, and clinic discounts also play a valuable role in making surgery more accessible.

By researching your policy, speaking with your provider, and exploring all financial options, you can approach laser eye surgery with clarity, confidence, and realistic expectations.